PNB Net Banking:How to use and activate PNB Net Banking in 2023,24/7 Access

Punjab National Bank (PNB) is one of the oldest and largest public sector banks in India. It was founded on May 19, 1894, in Lahore (now in Pakistan) under the name “Punjab National Bank Limited.” The bank played a crucial role in the economic development of India during the pre-independence era and post-independence period.

How to use PNB net-banking

1. Registration: If you haven’t registered for PNB’s internet banking services, you would need to start by registering. Here’s a typical process:

- Visit the official PNB website.

- Look for the “Internet Banking” section and find the option to register or enroll for internet banking.

- You might need your account number, ATM/Debit card details, and other personal information for verification.

- Follow the steps provided to create your net banking account and set up login credentials.

2. Logging In: Once you have registered and received your net banking credentials, you can log in:

- Visit the PNB net banking website.

- Look for the login section and enter your user ID and password.

3. Dashboard: After logging in, you will likely be directed to your account dashboard. The dashboard will display various options and features available to you, such as account balances, transaction history, fund transfers, bill payments, and more.

4. Services: PNB’s net banking portal typically offers a range of services that you can access online. These might include:

- Account Overview: View your account balances, recent transactions, and account statements.

- Funds Transfer: Transfer funds between your own accounts, to other PNB accounts, or even to accounts in other banks through NEFT/RTGS.

- Bill Payments: Pay utility bills, credit card bills, and other bills online.

- Online Shopping: Some net banking portals allow you to make online purchases using your account.

- Mobile Recharge: Recharge prepaid mobile phones.

- Investment Services: Depending on the bank, you might have access to services like fixed deposits, recurring deposits, etc.

- Profile Management: Update your contact details, change passwords, and manage your profile settings.

- Customer Support: Access customer service options for assistance and queries.

5. Security: Make sure you follow recommended security practices:

- Keep your login credentials confidential.

- Use strong passwords that include a mix of letters, numbers, and special characters.

- Regularly update your passwords.

- Avoid using public computers or unsecured networks for logging in.

- Beware of phishing attempts and only use the official PNB net banking website.

Please note that these steps are a general guideline based on the typical net banking process. The actual steps might vary, and it’s recommended to refer to the official PNB website or contact their customer support for the most accurate and up-to-date information on using their net banking services.

Benefits PNB Net Banking

Using Punjab National Bank’s (PNB) net banking services can offer several benefits to account holders. While the specific benefits may vary based on PNB’s offerings and any updates made since my last knowledge update in September 2021, here are some common benefits that online banking services like PNB’s net banking typically provide:

1. Convenience: Net banking allows you to access your account and perform various banking transactions from the comfort of your home or any location with internet access. This eliminates the need to visit a physical branch for routine tasks.

2. 24/7 Access: With net banking, you can access your account and perform transactions at any time of the day, including weekends and holidays. This flexibility is particularly useful when you need to manage your finances outside of traditional banking hours.

3. Account Management: You can view your account balances, transaction history, and account statements online. This helps you keep track of your finances and monitor your account activity in real-time.

4. Fund Transfers: Net banking allows you to transfer funds between your own accounts, to other accounts within PNB, or to accounts in other banks using services like NEFT (National Electronic Funds Transfer) and RTGS (Real-Time Gross Settlement).

5. Bill Payments: You can pay utility bills, credit card bills, insurance premiums, and other bills directly from your net banking account. This streamlines the bill payment process and reduces the need for writing checks or visiting bill payment centers.

6. Online Shopping: Some net banking portals offer the option to make online purchases and payments directly from your account. This can simplify online shopping and reduce the need to use credit or debit cards.

7. Mobile Recharge: You can recharge your prepaid mobile phones, DTH (Direct-to-Home) services, and other prepaid accounts using net banking.

8. Investment Management: Depending on the bank’s offerings, you might be able to manage investments such as fixed deposits, recurring deposits, and more through the net banking portal.

9. Security Features: Net banking platforms typically have security measures in place to protect your account, including two-factor authentication, secure login procedures, and encryption.

10. Cost Savings: Using net banking can save you money and time that you would otherwise spend on commuting to a physical bank branch. It also reduces the need for paper-based transactions.

11. Eco-Friendly: By opting for online statements and transactions, you contribute to reducing paper usage and promoting eco-friendliness.

12. Quick Services: Many transactions conducted through net banking are processed swiftly, enabling faster fund transfers and payments.

13. Enhanced Customer Support: Net banking portals often provide customer support services through online chat, email, or phone, allowing you to resolve queries and issues without visiting a branch.

Please note that the specific benefits might vary based on the features offered by Punjab National Bank and any changes made since my last update. It’s recommended to visit the official PNB website or contact their customer support for the most accurate and up-to-date information regarding the benefits of using their net banking services.

Using PNB Net Banking

PNB Net Banking (Punjab National Bank Net Banking) is an online banking service provided by Punjab National Bank, one of the largest public sector banks in India. It allows PNB account holders to perform various banking transactions and activities over the internet without the need to visit a physical bank branch. Here’s a general overview of how to use PNB Net Banking:

- Registration:

- Visit the official PNB Net Banking website.

- Look for the option to register for internet banking.

- You might need to provide your account number, customer ID, and other relevant information.

- Follow the on-screen instructions to create your login credentials.

- Login:

- Once registered, you can log in to your PNB Net Banking account using the user ID and password you created during registration.

- Some banks also provide an option for two-factor authentication, which adds an extra layer of security.

- Dashboard:

- After logging in, you’ll be directed to the dashboard, where you’ll find various options and services.

- Services and Transactions: PNB Net Banking offers a range of services and transactions, including but not limited to:

- Account Information: Check your account balance, view transaction history, and download statements.

- Fund Transfers: Transfer funds between your own accounts, to other PNB accounts, and to accounts in other banks using NEFT, RTGS, or IMPS.

- Bill Payments: Pay utility bills, credit card bills, and other payments online.

- Mobile Recharge: Recharge your mobile phone and DTH services.

- Online Shopping: Use your PNB Net Banking account to make online purchases.

- Fixed Deposits: Open and manage fixed deposit accounts.

- Loan and EMI Payments: Pay your loan installments and EMIs online.

- Investment Services: PNB might offer services related to investments and mutual funds.

- Security Measures:

- Keep your login credentials confidential and do not share them with anyone.

- Use strong and unique passwords.

- Always log out of your net banking session after use.

- Be cautious when using public computers or Wi-Fi networks.

- Customer Support:

- If you face any issues or need assistance, PNB usually provides customer support through phone numbers, email, or visiting a bank branch.

Customer Support PNB Net Banking

If you need customer support for PNB Net Banking or any other banking-related inquiries, you can reach out to Punjab National Bank through various channels. Here’s how you can contact their customer support:

- Phone Support:

- PNB generally provides customer support through phone numbers. You can call their customer care helpline to get assistance with your queries or issues related to net banking, account information, transactions, and more.

- Visit a Branch:

- If you prefer face-to-face interaction, you can visit your nearest PNB branch. The bank staff at the branch can help you with your queries and provide assistance with net banking registration, troubleshooting, and other services.

- Official Website:

- Visit the official Punjab National Bank website and look for the “Contact Us” section. They often provide a list of contact details, including phone numbers and email addresses, that you can use to get in touch with their customer support team.

- Email Support:

- PNB may also offer email support. You can send an email to their designated customer support email address explaining your query or concern. Make sure to include relevant details and contact information in your email.

- Social Media:

- Some banks use social media platforms such as Twitter and Facebook to provide customer support. You can try reaching out to PNB through their official social media accounts for assistance.

- Net Banking Dashboard:

- When you log in to your PNB Net Banking account, you might find a dedicated section for customer support or help. This section could contain FAQs, user guides, and contact information for support.

Always ensure that you are using official contact details provided by Punjab National Bank to avoid scams and phishing attempts. When contacting customer support, be prepared to provide relevant details such as your account number, customer ID, and any transaction reference numbers to help them assist you more effectively.

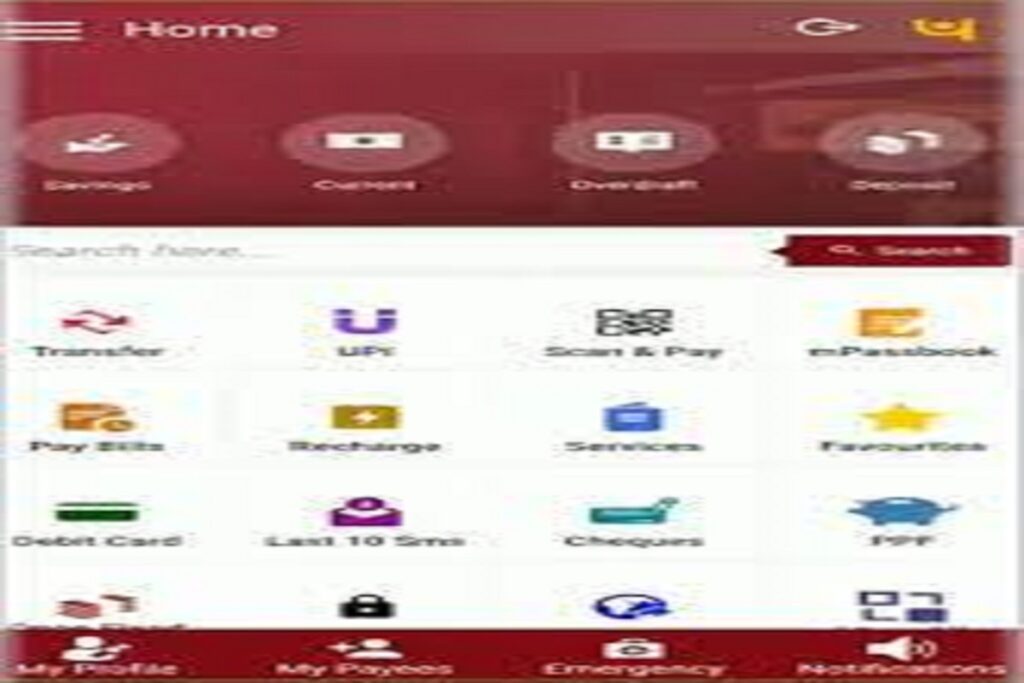

PNB Mobile Banking login

How to log in to PNB Net Banking. However, please note that the exact steps and procedures might have changed since then. For the most accurate and up-to-date information, I recommend visiting the official Punjab National Bank website or contacting their customer support.

Here’s a general process on how you might log in to PNB Mobile Banking:

- Download the App:

- Search for “PNB Mobile Banking” in your device’s app store (Google Play Store for Android or Apple App Store for iOS).

- Download and install the official PNB Mobile Banking app.

- Registration:

- If you’re a first-time user, you might need to register for mobile banking. This typically involves providing your account number, customer ID, and other relevant information.

- Search for “PNB Mobile Banking” in your device’s app store (Google Play Store for Android or Apple App Store for iOS).

- Download and install the official PNB Mobile Banking app.

- Login:

- Open the PNB Mobile Banking app.

- Enter your user ID and password. These are the credentials you created during the registration process.

- Some apps might offer biometric authentication (fingerprint or facial recognition) if your device supports it.

4. One-Time Password (OTP):

- Depending on the security measures in place, you might receive an OTP on your registered mobile number. Enter this OTP to complete the login process.

5. Access Your Account:

- After successful login, you should be able to access your PNB account through the mobile banking app.

- You’ll likely see a dashboard with various options such as account balance, transaction history, fund transfers, bill payments, and more.

History of PNB Net Banking

Punjab National Bank (PNB) is one of the oldest and largest public sector banks in India. PNB Net Banking, also known as PNB Internet Banking, is an online banking platform introduced by Punjab National Bank to offer its customers convenient and secure access to their accounts and banking services through the internet. While I don’t have access to real-time data, here’s a general overview of the history and evolution of PNB Net Banking up to my last knowledge update in September 2021:

- Early 2000s: Introduction of Online Services

- In the early 2000s, many Indian banks, including PNB, started introducing online banking services in response to the growing use of the internet and technological advancements.

- These services initially included basic functionalities like checking account balances and transaction histories.

- Mid-2000s: Enhanced Online Banking

- As technology advanced, PNB began to expand its online banking offerings to include features like fund transfers within the bank and utility bill payments.

- Customers could access these services through the bank’s official website using login credentials.

- 2008-2010: Introduction of PNB Internet Banking

- PNB officially launched its comprehensive internet banking platform, known as “PNB Internet Banking,” which allowed customers to perform a wide range of banking activities online.

- Customers could log in to their accounts, view account details, transfer funds to other PNB accounts, and conduct various transactions.

- 2010s: Advancements and Mobile Banking

- Over the years, PNB continued to enhance its internet banking platform with additional features such as interbank fund transfers using NEFT and RTGS.

- Mobile banking apps were introduced, enabling customers to access their accounts and perform transactions using their smartphones.

- Security Enhancements:

- As online banking gained popularity, PNB, like other banks, focused on enhancing security measures to protect customers’ sensitive information and transactions.

- Two-factor authentication (2FA) and other security protocols were implemented to prevent unauthorized access.

- Modernization and User Experience:

- PNB likely worked on improving the user interface and experience of its internet banking platform to make it more user-friendly and accessible.

- Ongoing Evolution:

- As of my last update in September 2021, PNB Net Banking was likely continuously evolving with advancements in technology. This could include introducing new services, enhancing security, and improving the overall online banking experience.

| NCMC Full Form:National Common Mobility Card 2023 QAB FULL FORM |QAB का क्या मतलब है?| QAB का पूर्ण रूप क्या है NEFT Full Form in Hindi। NEFT के बारे में पूरी जानकारी हिन्दी में । |

- How to Use HDFC NetBanking|एचडीएफसी नेट बैंकिंग का उपयोग कैसे करें

- How to Use SBI Net banking|,24/7 Access

Please keep in mind:

- These steps are based on general mobile banking practices and might not represent PNB’s exact process.

- Always ensure you download the official PNB Mobile Banking app from the official app stores to avoid fraudulent apps.

- Be cautious about the security of your login credentials and personal information.

For the most accurate and current instructions, visit the official Punjab National Bank website or contact their customer support directly.

RTGS FULL FORM |rtgs full form in hindi meaning

SWT full form in banking in Hindi

READ MORE

Arda Güler Biography in Hindi,अरदा गुलेर धर्म और जीवनी

Edwin van der Sar biography in hindi |एडविन वान डेर सार की जीवनी 2023

Korean singer Lee Sang Eun biography in Hindi

Andy Murray Biography in hindi |एंडी मरे की जीवनी हिंदी में

Mitchell Marsh Biography in Hindi|मिशेल मार्श की जीवनी 2023

kl rahul biography in hindi,केएल राहुल जीवनी जन्म 18 अप्रैल, 1992

Shubman Gill biography in hindi |शुबमन गिल की जीवनी,जन्म 8 अक्टूबर, 1999,Brilliant performance